Blockchain has certain similarities to a number of other emerging technologies like IoT and cloud-native broadly. There’s a lot of hype and there’s conflation of different facets or use cases that aren’t necessarily all that related to each other. I won’t say that MIT Technology Review’s Business of Blockchain event at the Media Lab on April 18 avoided those traps entirely. But overall it did far better than average in providing a lucid and balanced perspective. In this post, I share some of the more interesting themes, discussion points, and statements from the day.

It’s very early

Joi Ito, the Director of the MIT Media Lab, captured what was probably the best description of the overall sentiment about blockchain adoption when he said that we "should have a cautious but optimistic view.” He went on to say that “it's a long game” and that we should also "be prepared for quite of bit of change.”

In spite of this, he observed that there was a huge amount of investment going on. Asked why, he essentially shrugged and suggested that it was like the Internet boom where VCs and others felt they had to be part of the gold rush. “It’s about the money." He summed up by saying "we're investing like it's 1998 but it's more like 1989."

The role of standards

In Ito’s view standards will play an important role and open standards are one of the things that we should pay attention to. However, Ito also drew further on the analogues between blockchain and the Internet when he went on to say that "where we standardize isn't necessarily a foregone conclusion” and once you lock in on a layer (such as IP in the case of the Internet), it’s harder to innovate in that space.

As an example of the ongoing architectural discussion, he noted that there are "huge arguments if contracts should be a separate layer” yet we "can't really be interoperable until agree on what goes in which layer."

Use cases

Most of the discussion revolved around payment systems and, to a somewhat lesser degree, supply chain (e.g. provenance tracking).

In addition to cryptocurrencies (with greater or lesser degrees of anonymity), payment systems also encompass using blockchains to reduce the cost of intermediaries or eliminating them entirely. This could in principle better enable micropayment or payment systems for individuals who are currently unbanked. Robleh Ali, a research scientist in MIT’s Digital Currency Initiative notes that there’s “very little competition in the financial sector. It’s hard to enter for regulatory and other reasons." In his opinion, even if blockchain-based payment systems didn’t eliminate the role of banks, moving money outside the financial system would put pressure on them to reduce fees.

A couple of other well-worn blockchain examples involve supply chains. Everledger uses blockchain to track features such as diamond cut and quality, as well as monitoring diamonds from war zones. Another recent example comes from IBM and Maersk who say that they are using blockchain to "manage transactions among network of shippers, freight forwarders, ocean carriers, ports and customs authorities.”

(IBM has been very involved with the Hyperledger Project, which my employer Red Hat is also a member of. For more background on Hyperledger, check out my podcast and discussion with Brian Behlendorf—who also spoke at this event—from a couple months back.)

It’s at least plausible that supply chain could be a good fit for blockchain. There’s a lot of interest in better tracking assets as they flow through a web of disconnected entities. And it’s an area that doesn’t have much in the way of well-established governing entities or standardized practices and systems.

Identity

This topic kept coming up in various forms. Amber Baldet of JP Morgan went so far as to say “If we get identity wrong, it will undermine everything else. Who owns our identity? You or the government? How do you transfer identity?"

In a lunchtime discussion Michael Casey of MIT noted that “knowing that we can trust whoever is going to transact is going to be a fundamental question.” But he went on to ask “how do we bring back in privacy given that with big data we can start to connect, say, bitcoin identities."

The other big identity tradeoff familiar to anyone who deals with security was also front and center. Namely, how do we balance ease-of-use and security/anonymity/privacy? In the words of one speaker “the harsh tradeoff between making it easy and making it self-sovereign."

Chris Ferris of IBM asked “how do you secure and protect private keys? Maybe there’s some third-party custodian but then you're getting back to the idea of trusted third parties. Regulatory regimes and governments will have to figure out how to accommodate anonymity."

Tradeoffs and the real world

Which is as good a point as any to connect blockchain to the world that we live in.

As Dan Elitzer, IDEO coLAB, commented "if we move to a system where the easiest thing is to do things completely anonymously, regulators and law enforcement will lose the ability to track financial transactions and they'll turn to other methods like mass surveillance.” Furthermore, many of the problems that exist with title registries, provenance tracking, the unbanked poor, etc. etc. aren’t clearly the result of technology failure. Given the will and the money to address them in a systematic way that avoids corruption, monopolistic behaviors, and legal/regulatory disputes, there’s a lot that could be done in the absence of blockchains.

To take one fairly simple example that I was discussing with a colleague at the event, a lot of the information associated with deeds and titles in the US isn’t stored in the dusty file cabinets of county clerks because we lack the technology to digitize and centralize. They’re there for some combination of inertia, lack of a compelling need to do things differently, and perhaps a generalized fear of centralizing data. In other situations, “inefficiencies” (perhaps involving bribes) and lack of transparency are even more likely to be seen as features and not bugs by at least some of the participants. Furthermore, just because something is entered into an immutable blockchain doesn’t mean it’s true.

Summing up

A few speakers alluded to how bitcoin has served as something of an existence proof for the blockchain concept. As Neha Narula, Director of Research of DCI at the MIT Media Lab, put it, bitcoin has "been out there for eight years and it hasn't been cracked” even though “novel cryptographic protocols are usually fragile and hard to get right."

At the same time, there’s a lot of work still required around issues like scalability, identity, how to govern consensus, and adjudicating differences between code and the spec. (If the code is “supposed” to do one thing and it actually does another, which one governs?) And there are broader questions. Some I’ve covered above. There are also fundamental questions like: Are permissioned and permission-less (i.e. public) blockchains really different or are they variations of the same thing? What are the escape hatches for smart contracts in the event of the inevitable bugs? What alternatives are there to proof of work? Where does monetary policy and cryptocurrency intersect?

I come back to Joi Ito’s cautious but optimistic.

-----

Photos:

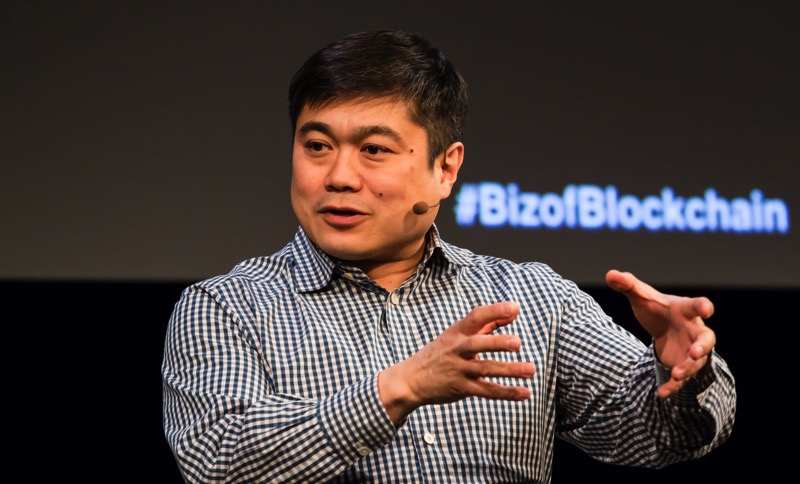

Top: Joi Ito, Director MIT Media Lab

Bottom: Amber Baldet, Executive Director, Blockchain Program Lead, J.P. Morgan

by Gordon Haff

No comments:

Post a Comment